Streamline Budgeting and Forecasting Processes

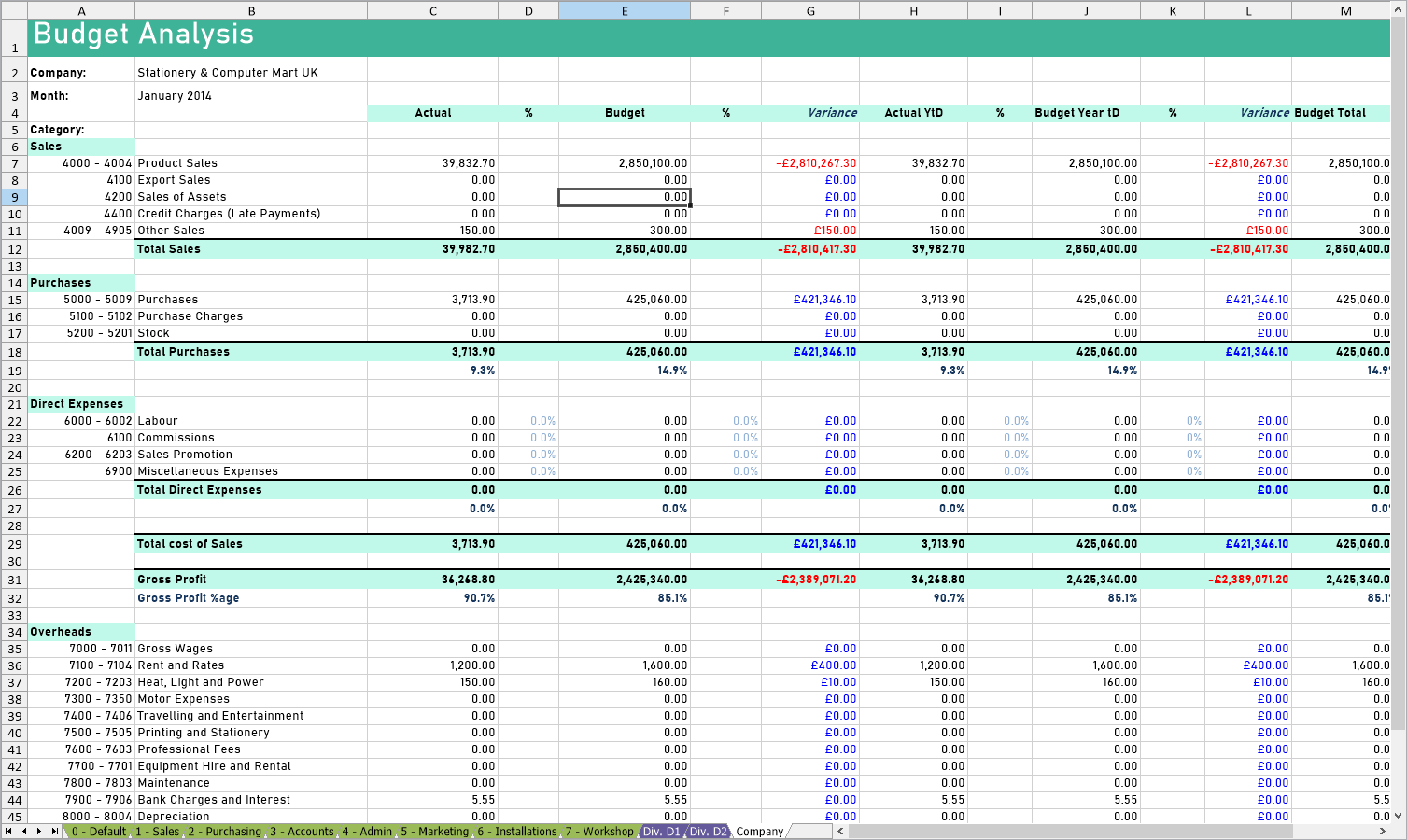

Display your budgets and actual figures alongside variances

Monitor your performance to plan for the future.

-

Reporting on Categories

-

Company/Department/Division Budgeting

-

Actuals versus Budget

-

Year-to-date reporting with the remaining Budget

-

Variances and financial year comparison

-

Multi-year

-

Fill the budget using the previous year's P&L

Why is Budgeting & Forecasting important?

Budgeting is crucial because it enables you to strategically plan and manage your company’s

revenue and expenses over a specified period. It plays a key role in long-term financial

planning and resource control, ensuring that your company can effectively allocate

resources.

What does ProudNumbers offer?

ProudNumbers delivers a comprehensive, top-down budgeting system designed to streamline

financial planning and resource allocation across your organization, offering a range of key

features that include:

Company/Departments/Divisions Budgeting

ProudNumbers allows you to define and customize your organizational structure. The system

supports comprehensive budgeting across the entire company, as well as for individual

divisions and departments.

Actuals versus Budget Reporting

ProudNumbers provides variance analysis, offering detailed comparisons between budgeted and

actual results on both a monthly and year-to-date basis. This functionality enables you to

monitor your business's financial health and progress toward goals, highlighting areas where

revenue targets are missed or costs exceed expectations.

Year-to-Date Reporting with Remaining Budget

Year-to-date reporting, combined with insights into the remaining

budget, gives you a realistic perspective on your financial standing for the rest of the

fiscal year. This feature allows for ongoing budget revisions based on actual data from

closed months and projections for the upcoming periods.

Reporting on Nominal Categories with Flexible Charts of Accounts

ProudNumbers simplifies the budgeting process by allowing reporting on nominal categories

instead of individual nominal codes, saving time and reducing complexity. The flexible

Charts of Accounts enable you to customize and adapt your financial structure, ensuring that

your budgeting aligns seamlessly with your specific reporting needs.

Multi-Year Budgeting and Historical Data Utilization

ProudNumbers supports multi-year budgeting, enabling you to plan across several fiscal

years. Additionally, you can fill budgets using the previous year’s Profit & Loss (P&L)

data, either at 100% or by specifying a percentage, making it easier to establish accurate

and informed budgets that reflect historical performance and trends.

ProudNumbers is independent management accounting software developed in the UK.

Contact the office

today to obtain a free 30-day trial licence key of ProudNumbers.